漢德百科全書 | 汉德百科全书

美国的大学

美国的大学

Die American Association for the Advancement of Science, auch genannt „Triple A-S“ (AAAS), ist die weltweit größte wissenschaftliche Gesellschaft und Herausgeberin mehrerer Zeitschriften, darunter Science und Science Advances. Der Leitspruch lautet „advance science and serve society“ (die Wissenschaft fördern und der Gesellschaft dienen), und der Auftrag der Gesellschaft sind der wissenschaftliche Fortschritt und weltweite Entwicklungen zugunsten der Menschheit. Sitz der Gesellschaft ist Washington, D.C.

美国科学促进会(英语:American Association for the Advancement of Science,缩写为AAAS),创建于1848年9月20日,是世界最大的非营利科学组织,下设21个专业分会,所涉包括数学、物理学、化学、天文学、地理学、生物学等自然科学学科。现有265个分支机构和1000万成员。《科学》杂志的主办者、出版者。

Die American Academy of Arts and Sciences (kurz American Academy) ist eine der ältesten und angesehensten Ehrengesellschaften (englisch honor society) der Vereinigten Staaten. Die über fünftausend Mitglieder, die ausschließlich von ihresgleichen in die Akademie gewählt werden können, sind herausragende Persönlichkeiten aus Kunst (engl. art) und Wissenschaft (engl. science). Die Gesellschaft wurde 1780 gegründet, und sie hat ihren Sitz in Cambridge, Massachusetts.

美国人文与科学院(又译为美国艺术与科学院、美国文理科学院,英语:American Academy of Arts and Sciences,简称 American Academy 或 AAAS )是美国历史最悠久的院士机构及地位最为崇高的荣誉团体之一,也是进行独立政策研究的学术中心。自从约翰·亚当斯、约翰·汉考克、詹姆斯·鲍登、罗伯特·崔特·潘恩及其他的建国先贤于独立战争期间创立人文与科学院以来,当选为其院士一直被认为是美国的最高荣誉之一。[1]

人文与科学院负有双重职能:从科学、人文、商业、政治、艺术等领域选举每个世代最优秀的学者及最具影响力的领袖成为其院士,以及针对社会的需要进行政策研究。[2] 目前人文与科学院的主要研究计划聚焦于高等教育与科研、人文与文化研究、科学与技术进展、美国政治、人口与环境、儿童福利等。其主办的季刊《代达罗斯》被广泛的认为是国际最重要的学术刊物之一

美国陆军战争学院(英语:United States Army War College;缩写为USAWC)是一所位于美国宾夕法尼亚州卡莱尔卡莱尔军营(Carlisle Barracks)的美国陆军教育机构[2],提供研究生水平的军事教育[3]。它每年招收约800名陆军军官,一半参加为期两年的远程学习课程,另一半参加为期十个月的校内全日制课程[3]。完成学业后,毕业生将获得战略研究(Strategic Studies)硕士学位[3]。

Das United States Army War College (USAWC) ist eine höhere Bildungseinrichtung der US Army. Das College befindet sich in Carlisle, Pennsylvania, auf dem historischen Gelände der Carlisle Barracks, einem Stützpunkt, dessen Geschichte bis in die 1770er Jahre zurückreicht. Es besteht aus verschiedenen Instituten, die der Forschung und der Ausbildung der Studenten in Führung, Strategie und der Führung von Verbundoperationen sowie internationaler Operationen dienen.

Das Army War College untersteht dem US Army Training and Doctrine Command (TRADOC) und gilt als eine der renommiertesten Bildungseinrichtungen des Heeres.

Das Command and General Staff College (CGSC) der United States Army in Fort Leavenworth, Kansas, Vereinigte Staaten, ist eine höhere Bildungseinrichtung der US-Streitkräfte, für die Ausbildung der militärischen Führungsspitze. Es wurde ursprünglich 1881 als Schule für die Infanterie und die Kavallerie gegründet.

美国陆军指挥参谋学院(英语:United States Army Command and General Staff College),简称陆军指参学院(CGSC,或是已经废除的USACGSC),为美国陆军在堪萨斯州莱文沃思堡的研究生院。1881年由南北战争北方将军威廉·特库姆塞·舍曼创立的步兵骑兵应用学校(School of Application for Infantry and Cavalry),后更至现名,是一所培养步兵和骑兵军官的培训学校。[3]1907年,它将名称改为行伍学校(School of the Line)。该课程在第一次世界大战、第二次世界大战、朝鲜战争和越南战争期间不断扩大,并继续调整,以包括从当前的战斗中吸取教训。

除了位于莱文沃思堡的主校区外,学院在弗吉尼亚州的贝尔沃堡、弗吉尼亚州的李堡、佐治亚州的戈登堡和阿拉巴马州的红石兵工厂设有卫星校区。该学院还保持了部分的远程学习教学模式。

A college endowment refers to all the money that an institution receives in donations. However, endowment funds are not ‘no-questions-asked’ cash boosts for the college. Instead, endowments are tightly controlled investments that are supposed to be grown so that the interest can be used to upgrade facilities, hire new staff, provide scholarships or aid the college or its students in some way.

Over the past three decades, the total market value of the 20 largest college endowments has grown nearly tenfold — from $30.6 billion to $302.1 billion. As the size of college endowments has increased, so too has the debate over their purpose, management and ethical obligations.

To get a better idea of how college endowments have changed over the last 30 years, DegreeQuery looked at the market value of the 20 largest U.S. college endowments from 1990 to 2020.

30 Years of U.S. college endowments

Based on the most recent NACUBO survey of 810 universities, the total market value of endowments in 2018 was $624.3 billion. 48.3% of that is held by just 20 colleges. But why the huge growth in market value over the past 30 years? It might be something to do with how much of the endowment the university chooses to spend on operations or the return rates of the endowment’s investment portfolio. Due to their often wealthy donor base and long-term investment horizons, the largest university endowments can invest in a diverse array of asset classes, and often grow faster than the economy as a whole.

From 1990 to 2020, the market value of the 20 largest college endowments grew at an average annual rate of 8.5% — faster than the 6.6% average annual growth rate for the Fortune 500 over the same period. The universities with the fastest growth over the past 30 years include the University of Michigan, Duke University and the University of Notre Dame. Meanwhile, the endowments with the slowest growth include Emory University, Rice University and Washington University in St. Louis.

1. U.S. college endowments in the 1990s

From 1990 to 1999, the market value of the 20 largest U.S. college endowments grew at an average annual rate of 12.5% — the fastest of the last three decades. As you can see from our graph, over this period, the University of Michigan endowment rose from the 20th largest to the 17th largest, and the University of Pennsylvania rose from the 16th largest to the 12th largest. Meanwhile, the Columbia University endowment fell from the sixth-largest to the 11th largest. Although the University of Texas System endowment had the slowest growth of the 20 largest endowments over this period, it remained the second-largest endowment overall.

2. U.S. college endowments in the 2000s

Endowment growth is closely connected with the overall health of the economy. As of 2018, just 4% of endowment assets were held as cash, the rest invested in equities, fixed income instruments and alternative investment vehicles. In the lead up to the 2008 financial crisis — university endowments had increasingly invested in high-risk, illiquid investments like private equity, real estate and hedge funds. As a result, endowments lost tens of billions of dollars in value, with some schools losing more than 25% of their total endowment value. From 2008 to 2009, the total value of the 20 largest endowments fell 3.4%. Yale posted the largest percentage decline, losing 28.6% of its market value. Other university endowments that posted big losses from the recession include Harvard, Duke and Stanford.

3. U.S. college endowments in the 2010s

Endowment growth rates rebounded in the wake of the Great Recession, although growth was still slow compared to the 1990s. From 2010 to 2018, the market value of the 20 largest endowments grew at an average annual rate of 7.6%. This is more than the 3.5% average annual growth rate for 2000 to 2009, yet less than the 12.5% rate for 1990 to 1999. During this period, the biggest winners were the University of Pennsylvania, rising from 11th to 7th largest, and the Texas A&M University System, which rose from 10th to 8th largest. Lackluster performance at some of the wealthiest schools has prompted some universities to make major changes to their endowment management. In 2017, for example, Harvard announced it would lay off roughly half of its 230-person staff in the wake of poor investment performance.

As you can see, university endowments were big business over the past 30 years. Nowadays, students, policymakers and the general public are increasingly involved in the conversation surrounding their management, mission and societal impact. For example, the 2017 Tax Cuts and Jobs Act, which imposed a 1.4% tax on the net investment income of the wealthiest endowments, recently sparked a wave of criticism from university administrators. Elsewhere on campus, protesting students demanded their universities divest from fossil fuel companies.

As the debate rages on and endowments continue to grow, these visualizations help us see how we got to this point.

Methodology

To get a better idea of how college endowments have changed over the last 30 years, DegreeQuery looked at the market value of the 20 largest U.S. college endowments from 1990 to 2018. Data on endowment asset value by university came from the National Association of College and University Business Officers (NACUBO) and is unadjusted for inflation. In years when certain universities did not participate in the NACUBO survey, we estimated the endowment value based on the compound annual growth rate for all available years. Estimated figures include the market value of the endowment assets for the Texas A&M University System for 1990, as well as the market value of the endowment assets for the University of California system for the years 1990 through 1992.

SOURCES

Fortune 500. (n.d.) Fortune 500 2018. fortune.com

NACUBO. (2019). Detailed Asset Allocations for U.S. College and University Endowments and Affiliated Foundations, FY18. nacubo.org

Miller, C. & Fabrikant, G. (2008). Universities retrench as endowments suffer from financial crisis. nytimes.com

Humphreys, J. et al. (2010). Educational Endowments and the Financial Crisis: Social Costs and Systemic Risks in the Shadow Banking System. tellus.org

Plender, J. (2014). There is a history lesson to be learnt from Yale endowment. ft.com

Fabrikant, G. (2017). Harvard Makes Changes in Managing a Lagging Endowment. nytimes.com

Tax Policy Center. (n.d.). What is the tax treatment of college and university endowments? taxpolicycenter.org

科学技术

科学技术

军事、国防和装备

军事、国防和装备

科罗拉多州

科罗拉多州

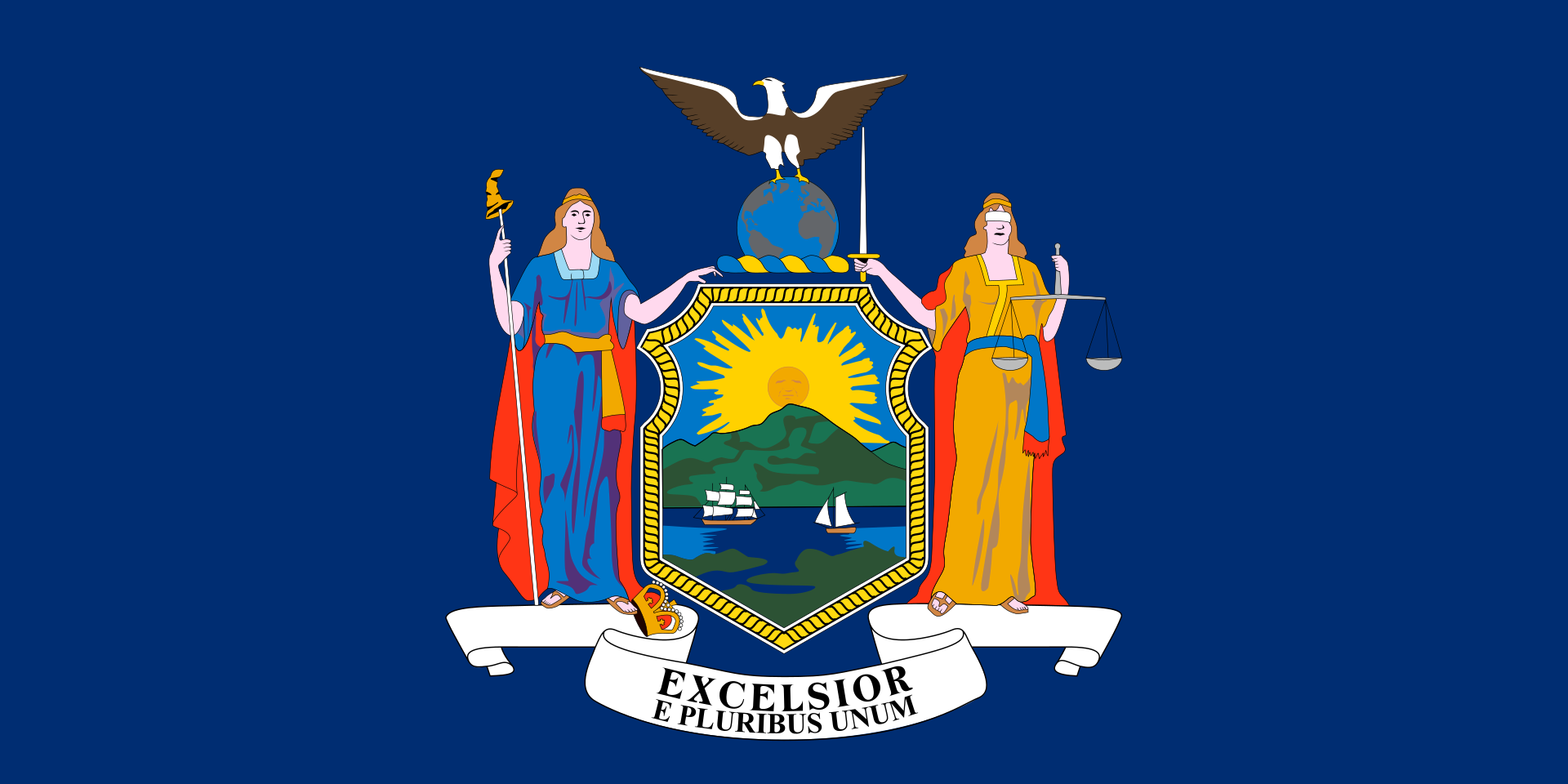

纽约州

纽约州

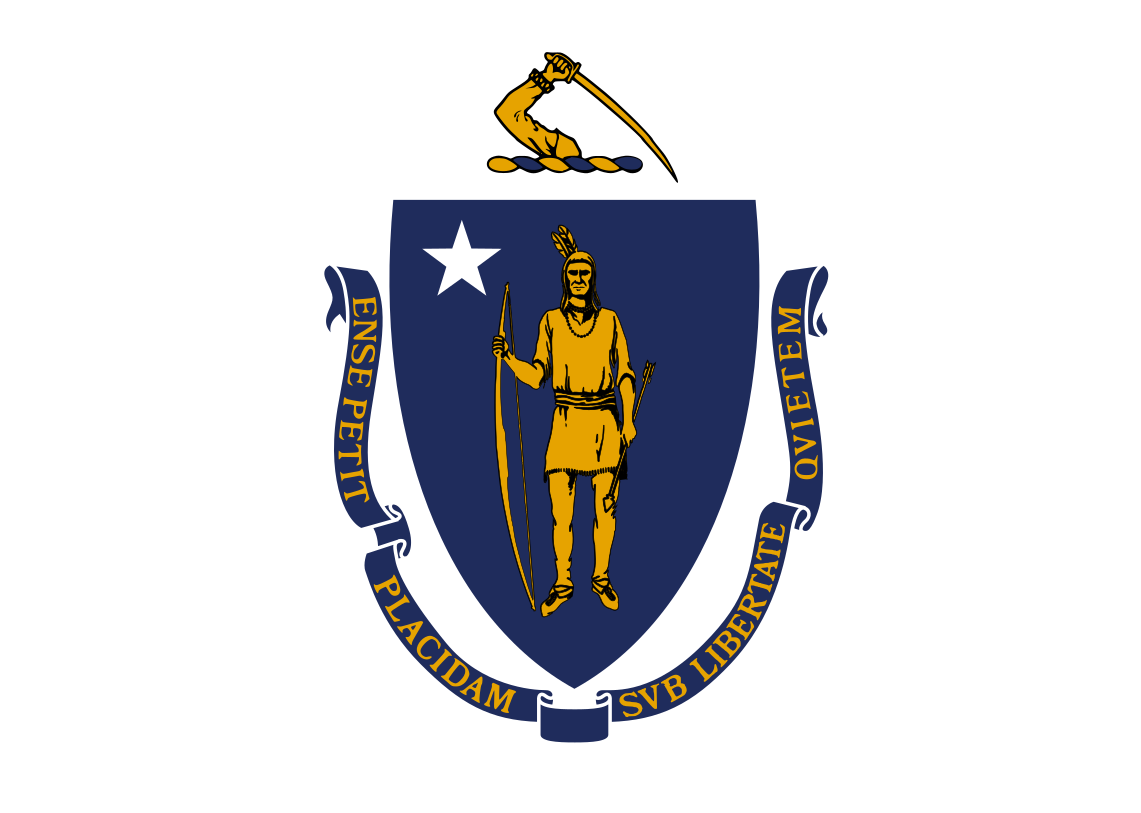

马萨诸塞州

马萨诸塞州

华盛顿哥伦比亚特区

华盛顿哥伦比亚特区

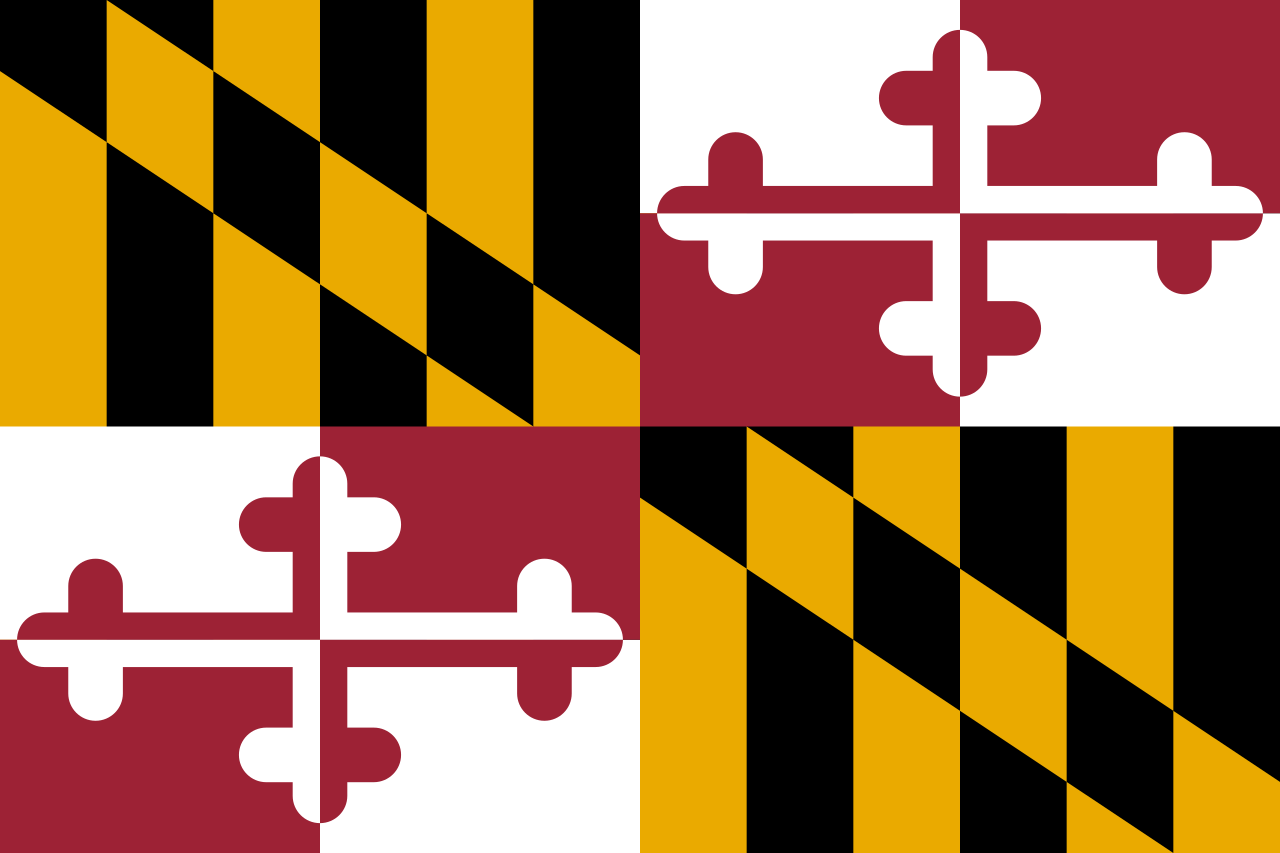

马里兰州

马里兰州

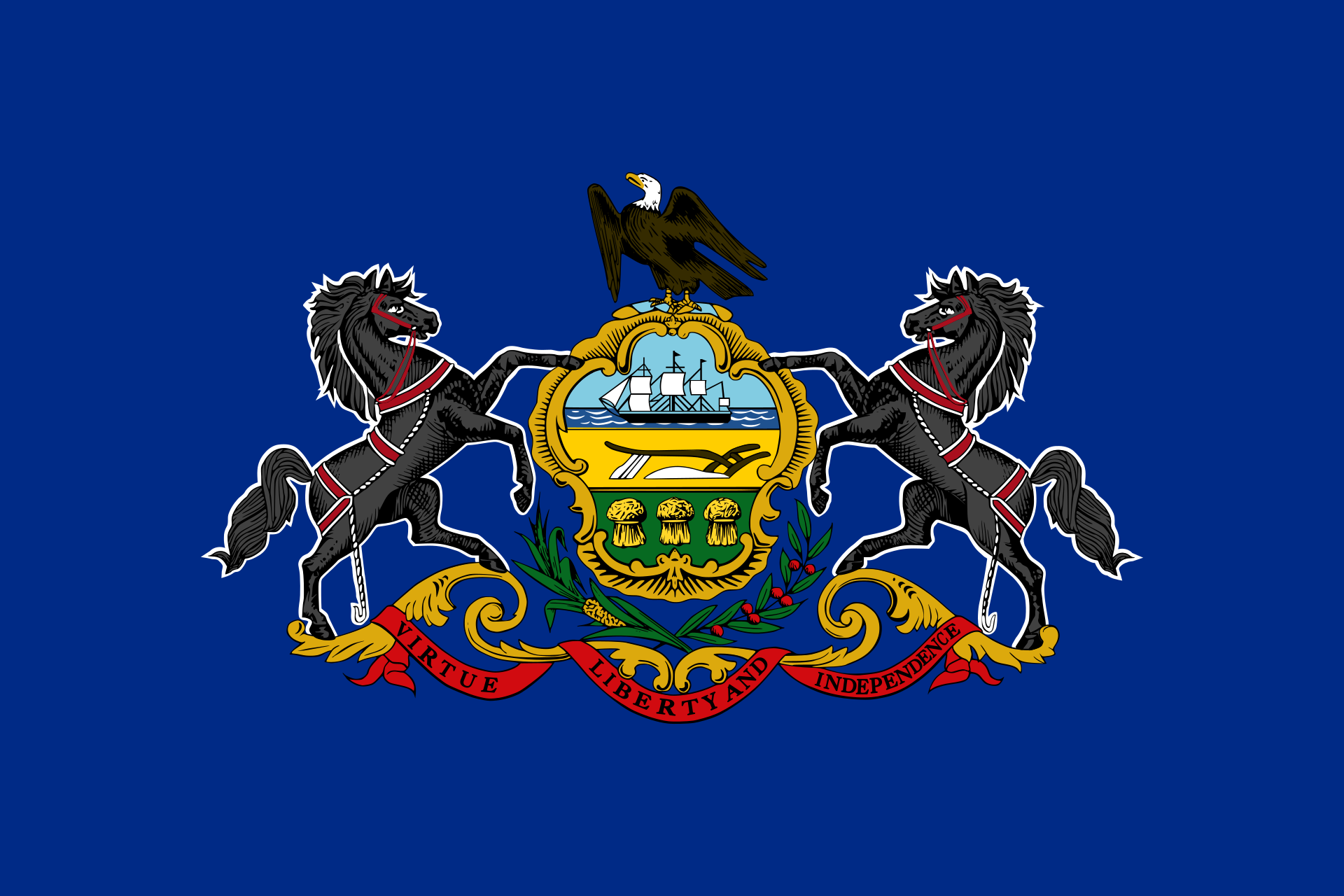

宾夕法尼亚州

宾夕法尼亚州

堪萨斯州

堪萨斯州

蒙大拿州

蒙大拿州

新泽西州

新泽西州