美国养老保险制度已有200多年历史,经过长期发展,现行的体系主要由三大支柱构成。第一支柱是由政府主导、强制实施的联邦退休金制度。第二支柱是由企业主导、雇主和雇员共同出资的企业年金计划。第三支柱是由个人负责、自愿参加的个人退休金计划。 这三大支柱俗称“三脚凳”,分别发挥政府、企业和个人作用,相互补充,形成合力,为退休人员提供多渠道、可靠的养老保障。

一、联邦退休金制度 联邦退休金制度是美政府为退休人员提供的一种保障型社会福利,是由政府主导的最基本的保险制度。具体内容如下: (一)缴纳社会保障税 社会保障税是联邦退休金制度最核心的内容。社会保障税由联邦政府按照一定工资比率在全国范围内统一征收,强制要求企业在每月发工资时代扣代缴。社会保障税由美财政部国内工资局集中收缴后,进入美社会保障署设立的社会保障基金。

(二)社会保障税税率 社会保障税税率由社会保障署动态调整。调整依据是根据人口老龄化预测数据和养老金支出需要。例如,社会保障税税率在1980年时为雇员工资额的10.16%,1990年上调至12.4%。自1990年以来,社会保障税税率未再调整。2015年社会保障税税率为雇员工资额的12.4%,由雇员和雇主各缴纳50%。即,雇员和雇主各缴纳该雇员工资额的6.2%。 联邦退休金制度鼓励“工作时多存社保税、退休后多领养老金”。工资较高的雇员,缴纳的社会保障税更多,退休后领取的联邦退休金也更多。同时,为体现社会公平性,防止极少数退休人员领取过高退休金,社会保障税设定了应税工资上限,超出应税工资上限那部分工资不再缴纳社会保障税。应税工资上限随着物价和工资水平的变化而逐年调整。

(三)领取联邦退休金 联邦退休金制度规定,雇员必须纳税40个季度(相当于10年缴费年限),退休后才能按月领取联邦退休金。退休金计发与实际退休年龄挂钩。联邦退休金制度对不同时间出生的人规定了不同的法定退休年龄。到法定退休年龄才退休者,可享受全额退休金。联邦退休金制度不实行强制退休,在法定退休年龄之前退休者,退休金减额发放,每提前一个月养老金减发0.56%,最早可以提前至62岁退休;鼓励在法定退休年龄之后退休,每延后一个月退休金增加0.25%。 退休人员领取联邦退休金时免税,但年总收入超过一定金额者需纳税。联邦退休金的受益人除了退休人员本人,还包括其符合特定条件的配偶、未成年孩子等。

二、企业年金计划(401K计划)

企业年金计划是一种由企业主导、雇主和雇员共同缴费、享受税收优惠的企业补充养老金制度,是美国雇主提供的一种常见的退休福利计划。

(一)产生背景

在20世纪80年代之前,很多私人企业都由雇主全额承担雇员退休金,特别是在工会组织力量强大的企业,雇主不得不承担大量的福利支出。虽然这种退休福利方式对员工有利,但它增加了雇主的经济负担,对企业经营和发展不利。1978年,美国通过的《国内税收法》新增了第401条K项条款,允许政府机构、企业和非营利组织等不同类型雇主为雇员建立积累制养老金账户,并享受税收优惠。随着时间的推移,越来越多的美国企业选择了雇主和雇员共同缴费、合建退休福利的方式。因此,美国企业年金计划又被称为401K计划。

目前,401K计划已成为美国众多雇主首选的企业补充养老保障制度。根据美国投资公司协会的数据,截至2013年第二季度,401K计划的账户资产总额达到3.79万亿美元,相当于当年美国GDP的22.9%左右。

(二)税收优惠

401K计划被广泛认为是为中产阶级提供的一大福利,参与该计划的退休人员以及他们的受益人能够获得实际的税收优惠。

税收优惠的具体体现是延迟纳税(Tax Defer)。根据法律规定,雇员在401K账户中的缴费和投资收益不会被征税,直到从帐户中领取养老金时才需要缴纳个人所得税。由于退休人员的收入通常会减少,因此纳税基数也会相应减少。再加上投资收益免税的待遇,实际上退休人员需要缴纳的个人所得税会大幅下降。

(三)领取条件

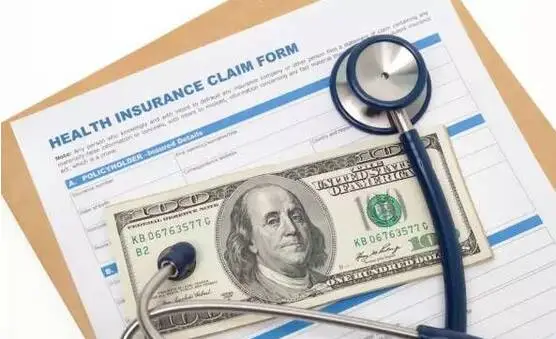

401K计划的养老金领取条件包括以下几种情况:账户持有人年满59.5岁;死亡或永久丧失工作能力;发生大于年收入7.5%的医疗费用;在55岁以后离职、下岗、被解雇或提前退休。如果账户持有人在59.5岁之前提前领取养老金,将被征收惩罚性税款。然而,401K计划允许提前借款,并且可以将借款还回账户。

当账户持有人退休时,可以选择一次性领取、分期领取或将资金转为存款等方式使用401K账户中的资金。而在雇员满70.5岁时,必须开始从个人账户中取款,否则将面临对应取款额的50%税收。该规定的目的是刺激退休者消费,避免社会陷入消费不足的困境。

三、个人退休金计划(IRA计划)

个人退休金计划(IRA计划)是一种个人补充养老金计划,由联邦政府提供税收优惠并由个人自愿参与。该计划始于上世纪70年代,核心是建立个人退休账户(Individual Retirement Accounts,简称IRA).

(一)帐户管理

与401K账户不同,IRA账户是由参与者自行设立的。任何年满16岁且年薪不超过一定数额(70.5岁以下)的个人都可以在有资格设立IRA账户的金融机构(如银行、基金公司等)开设自己的IRA账户,而且无论其是否参加其他养老金计划。参与者可以根据自己的收入确定每年的缴费金额,并在每年的4月15日之前存入账户。然而,IRA有最高缴费限额。例如,2014年,50岁以下的参与者最高缴费限额为5000美元。此外,如果年薪超过一定数额,参与者将无法申请IRA计划。举例来说,未婚者的年薪超过5.6万美元,已婚者的年薪超过8.9万美元,则不能申报该年度的IRA计划。

参与者自行管理IRA账户,开户银行和基金公司等金融机构提供不同组合的IRA基金投资建议。参与者根据自身情况和投资偏好进行投资管理,承担风险自负。IRA账户具有良好的转移机制,当户主换工作或退休时,可以将401K计划的资金转移至IRA账户,避免不必要的损失。户主退休后从账户中领取养老金,领取金额取决于缴费数额和投资收益状况。

(二)税收优惠

IRA计划是一种储蓄行为而非投资行为。参与者可以使用账户内的资金进行股票、债券等投资活动,但本金和收益受到严格限制,必须存储在IRA账户内,无法转移至其他账户,这样做是为了在退休后才能使用这部分资金。

与普通投资账户相比,IRA账户具备许多税收优惠。首先是延迟纳税,参与者可在年度免税额度内(即最高缴费限额)免除个人所得税,而在支取养老金时才需纳税。其次,账户内的存款利息、股息和投资收益免征个人所得税。参与者可以选择存储税前或税后收入,如果是税前存储,领取时需缴纳个人所得税;如果是税后存储,则需要缴纳多年来的附加增值款的个人所得税。税收优惠政策推动了IRA计划的快速发展。截至2012年底,44.7%的美国家庭拥有IRA账户。

(三)退休金领取条件

根据规定,IRA(个人退休账户)的户主必须年满59.5岁才能领取退休金,否则提前支取将被处以支取金额10%的罚金。政府的目的是鼓励户主在退休后再开始使用IRA资金。法规同时规定,户主在年满70.5岁时必须开始支取账户金额。

最近几年,IRA计划衍生出了不同类型的个人退休账户,如Roth IRA、SEP IRAs、SIMPLE IRA等。与传统IRA不同,这些账户在缴费条件、年度免税额度、支取时间、免税方式等方面提供了不同的选择,以满足个体工商户和小企业主等不同人群根据自身收入和就业情况进行个性化安排。例如,Roth IRA在存款时需要缴纳个人所得税,存入的是已经缴税的资金,但在退休时可以免税支取,并且不要求户主在年满70.5岁时必须支取账户金额。此外,未婚者和已婚者的年收入如果分别高于12.5万美元和18.3万美元,则不可申请Roth IRA计划等。

总的来看,联邦退休金制度、401K计划和IRA计划分别发挥了政府、企业和个人的作用,实现了多层次的养老保障效果。联邦退休金制度提供了最基本的养老保障,可以说是一种底线保障;而401K计划和IRA计划则能有效提高退休人员的实际收入,给予额外的养老资金支持。目前,虽然还有很多美国企业未参与401K计划,但随着“婴儿潮一代”逐步进入退休年龄,401K计划将在美国养老保险体系中变得越来越重要。

四、人寿保险具备税务优势

各种永久性的人寿保险拥有现金价值,在滚动过程中不需要缴纳税款;

如果将现金价值在保险有效期内提取或借出,也不会涉及税务问题;

在被保险人去世时,死亡赔偿金无需缴纳所得税;

将人寿保险设立为不可撤销的信托,死亡赔偿金也无需缴纳遗产税;

在某些合格的养老金计划中,如确定利益计划(defined benefit),保费可以作为税务抵扣。

五、人寿保险的现金价值和死亡赔偿金不受债权人和诉讼追索

在美国,人寿保险被视为资产保护的有效工具,高收入、高风险行业(如医生)的人士通常购买大额人寿保险。在国内,快速积累财富的同时也伴随着较高的风险。一旦意外发生,个人可能面临资产被追缴、入狱甚至剥夺政治权利的危险。

近年来,越来越多的国内富有人士选择在美国购买高额保险,主要是看中人寿保险不受债权人和诉讼索赔的限制。作为法治社会,美国保护私人财产的法律体系为人寿保险提供了特殊的保障,尽管财富的积累并非易事。

我们建立于美国当地的团队位于加州湾区(近硅谷),为新老移民提供“一站式”落地安家服务。包括租房购房、美国税务,美国保险、资产投资配置等等。团队负责人在美国资产传承方面做了很多深入的研究。通过提前规划,达到优化客户的传承方案。

资深置业团队拥有多年从业经历,层层筛选,精准把握美国的房产趋势及实时动态(涉及旧金山、洛杉矶、亚特兰大、纽约、西雅图等多个城市),为您提供精准详实的房源及学区与社区信息,严选优房。协助购房贷款申请,为买家提供“量身订制”的最佳房源信息,实现在美国买房置业的梦想。

专业、细致、认真的财税团队拥有着十余年的私人财富管理经验,曾协助上百组家庭在美投资,并协助解决相关税务问题。 (Quelle:原创 有一说一 海外生活私享会)

An ascot tie, ascot or hanker-tie is a neckband with wide pointed wings, traditionally made of pale grey patterned silk.[citation needed] This wide tie is usually patterned, folded over, and fastened with a tie pin or tie clip. It is usually reserved for formal wear with morning dress for daytime weddings and worn with a cutaway morning coat and striped grey formal trousers. This type of dress cravat is made of a thicker, woven type of silk similar to a modern tie and is traditionally either grey or black.[citation needed] A more casual form of ascot is in British English called a cravat, or sometimes as a day cravat to distinguish it from the formal ascot or dress cravat. The casual form is made from a thinner woven silk that is more comfortable when worn against the skin, often with ornate and colourful printed patterns.

The ascot is descended from the earlier type of cravat widespread in the early 19th century, most notably during the age of Beau Brummell, made of heavily starched linen and elaborately tied around the neck. Later in the 1880s, amongst the upper-middle-class in Europe men began to wear a more loosely tied version for formal daytime events with daytime full dress in frock coats or with morning coats. It remains a feature of morning dress for weddings today. The Royal Ascot race meeting at the Ascot Racecourse gave the ascot its name, although such dress cravats were no longer worn with morning dress at the Royal Ascot races by the Edwardian era. The ascot was still commonly worn for business with morning dress in the late 19th and very early 20th centuries.

A necktie, or simply a tie, is a piece of cloth worn for decorative purposes around the neck, resting under the shirt collar and knotted at the throat, and often draped down the chest.

Variants include the ascot, bow, bolo, zipper tie, cravat, and knit. The modern necktie, ascot, and bow tie are descended from the cravat. Neckties are generally unsized but may be available in a longer size. In some cultures, men and boys wear neckties as part of office attire or formal wear. Women wear them less often. Neckties can also be part of a uniform. Neckties are traditionally worn with the top shirt button fastened, and the tie knot resting between the collar points.

In 1999, Lord Portman became the 10th Viscount and began work on rejuvenating the Estate.

Over the last 20 years, the development of the Estate has gone from strength to strength. We actively manage the property assets, both directly as a landlord to an ever-increasing number of residential and commercial customers, and through our relationships with long-term leaseholders.

We aim to be at the forefront of

property management and placemaking in Central London. This is an example of how an estate can combine a modern, agile and forward-thinking approach to its activities, while remaining loyal to its history, heritage and values.

The Portman Estate dates back to the 16th century, when Sir William Portman, Lord Chief Justice to King Henry VIII,[5] and originally from Orchard Portman in Somerset, leased 270 acres of the Manor of Lileston (Lisson). He acquired the freehold in 1554, but most of the land remained farmland and meadow until the mid-18th century and the building boom after the end of the Seven Years' War in 1763.

In the 1750s William Baker had leased land from the family to lay out Orchard and Portman Streets, and the north side of Oxford Street. Henry William Portman, a descendant of Sir William, continued the development in 1764 with the creation of Portman Square, with buildings by James Wyatt, Robert Adam and James 'Athenian' Stuart, including Montagu House, built in the north-west corner for the famed literary hostess Elizabeth Montagu and later used by the Portman family as their London town house.

Portman Square was the focus of the new estate and was followed by the building of Manchester Square during the 1770s and Bryanston and Montagu Squares 30 years later. These were laid out by the Estate's architect, James Thompson Parkinson. The area remained largely residential, attracting the prosperous middle class who wanted to live near the centre of London. There were also mews for tradesmen and servants. At the southwest corner of the Estate, where Marble Arch now stands, was the Tyburn gallows, London's principal place of public execution until 1783.

Development of the area north of the Marylebone Road around Dorset Square continued after 1815, and to the North West in Lisson Green, workers’ cottages were built from 1820 to 1840. Many of the original Georgian houses north of Portman Square were redeveloped as mansion blocks, which were let on long leases. This development spread along the major traffic routes of Edgware Road and Baker Street.

In 1948 the Estate, then valued at £10 million, was subject to death duties of £7.6 million on the death of the seventh Viscount Portman, resulting in the sale of all the family's West Country estates as well as the northern part of the London Estate in 1951, and the area around Crawford Street the following year. In the later 1950s and 1960s the Estate collaborated with the developer Max Rayne to redevelop the frontage of Oxford Street and Baker Street, as well as the south and west sides of Portman Square.

The bow tie /boʊ/ is a type of necktie. A modern bow tie is tied using a common shoelace knot, which is also called the bow knot for that reason. It consists of a ribbon of fabric tied around the collar of a shirt in a symmetrical manner, so that the two opposite ends form loops.

There are generally three types of bow ties: the pre-tied, the clip on, and the self tie. Pre-tied bow ties are ties in which the distinctive bow is sewn onto a band that goes around the neck and clips to secure. Some "clip-ons" dispense with the band altogether, instead clipping straight to the collar. The traditional bow tie, consisting of a strip of cloth which the wearer has to tie by hand, is also known as a "self-tie", "tie-it-yourself", or "freestyle" bow tie.

Bow ties may be made of any fabric material, but most are made from silk, polyester, cotton, or a mixture of fabrics. Some fabrics (e.g., wool or velvet) are much less common for bow ties than for ordinary four-in-hand neckties.