My channels - What are the aspects of the United States that attract the world?

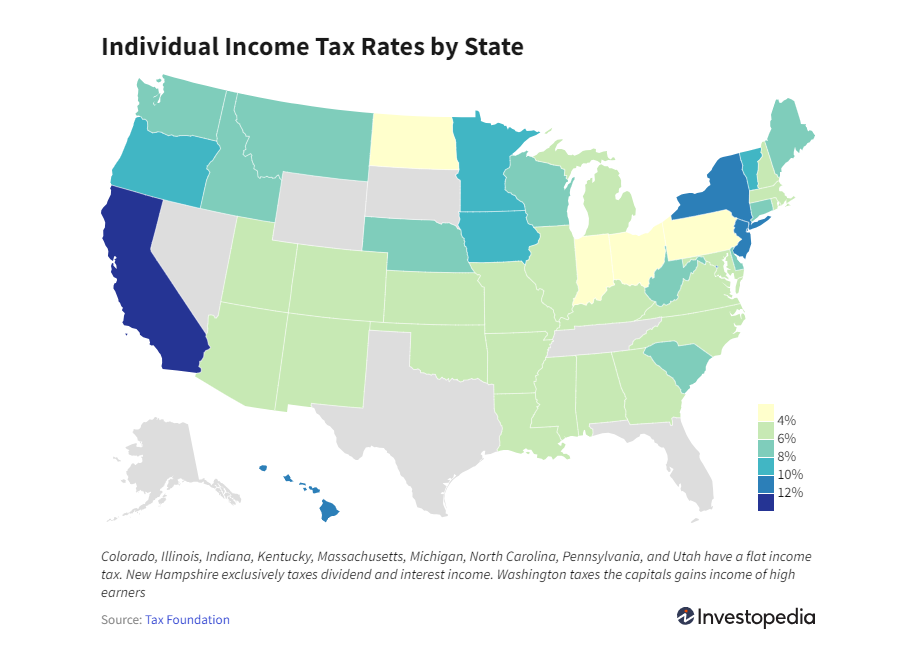

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not levy state income taxes, while New Hampshire doesn’t tax earned wages.

- States with no income tax often make up the lost revenue with other taxes or reduced services.

- A state’s total tax burden, which measures the percent of income paid in state and local taxes, could be a more accurate measure of its affordability than its income tax rate alone.

- Other factors—including healthcare, cost of living, and job opportunities—are also important in determining how expensive a state is.

- Sales, excise, and property taxes

- Affordability

- The impact of lower taxes on a state’s ability to invest in social services, such as infrastructure, education, and healthcare

In the United States, higher education is an optional stage of formal learning following secondary education. It is also referred as post-secondary education, third-stage, third-level, or tertiary education. It covers stages 5 to 8 on the International ISCED 2011 scale. It is delivered at 4,360 Title IV degree-granting institutions, known as colleges or universities. These may be public or private universities, research universities, liberal arts colleges, community colleges, or for-profit colleges. US higher education is loosely regulated by the government and by several third-party organizations.

There is a clear hierarchy of colleges and universities in the US, with the most selective institutions (e.g., Ivy League schools) at the top and the least selective institutions (e.g., community colleges) at the bottom. White supremacy and academic profit-seeking have played major roles in this stratification.

Attending college has been thought of as "a rite of passage" to which the American Dream is deeply embedded. However, there is a growing skepticism of higher education in the US and its value to consumers.

In 2022, about 16 million students—9.6 million women and 6.6 million men—enrolled in degree-granting colleges and universities in the US. Of the enrolled students, 45.8% enrolled in a four-year public institution, 27.8% in a four-year private institution, and 26.4% in a two-year public institution. College enrollment has declined every year since a peak in 2010–2011 and is projected to continue declining or be stagnant for the next two decades.

Strong research funding helped elite American universities dominate global rankings in the early 21st century, making them attractive to international students, professors and researchers. The US higher education system is also unique in its investment in highly competitive NCAA sports, particularly in American football and basketball, with large sports stadiums and arenas adorning its campuses and bringing in billions in revenue.

21st century

Changing technology, mergers and closings, and politics have resulted in dramatic changes in US higher education during the 21st century.

In 2020, when the COVID-19 pandemic upended regular campus life forcing students to take online classes at home, more than 100 colleges, both public and private have been sued for tuition refunds, making many of them to reopen their campuses.

Online education: MOOCs and OPMs

Online education has grown in the early 21st century. More than 6.3 million students in the US took at least one online course in fall 2016. While online attendance has increased, confidence among chief academic officers has decreased from 70.8 percent in 2015 to 63.3 percent in 2016. In 2017, about 15% of all students attended exclusively online, and competition for online students has been increasing

By 2018, more than one hundred short-term coding bootcamps existed in the US. Programs were available at Harvard University's extension school and the extension schools at Georgia Tech, University of Pennsylvania, Cal Berkeley, Northwestern, UCLA, University of North Carolina, University of Texas, George Washington, Vanderbilt University, and Rutgers through Trilogy Education Services.

In 2019, researchers employed by George Mason University claimed that online education had "contributed to increasing gaps in educational success across socioeconomic groups while failing to improve affordability".

A MOOC is a massive open online course aimed at unlimited participation and open access via the web. It became popular in 2010–14. In addition to traditional course materials such as filmed lectures, readings, and problem sets, many MOOCs provide interactive user forums to support community interactions between students, professors, and teaching assistants.[56] Robert Zemsky (2014), of the University of Pennsylvania Graduate School of Education notes that they at first seemed to be an extremely inexpensive method of bringing top teachers at low cost directly to students. However, very few students—usually under 5%—were able to finish a MOOC course. He argues that they have passed their peak: "They came; they conquered very little; and now they face substantially diminished prospects." In 2019, researchers at MIT found that MOOCs had completion rates of 3 percent and that the number of people taking these courses has been declining since 2012–13.[58]

Online programs for many universities are often managed by privately owned companies called online program managers or OPMs. The OPMs include 2U, Academic Partnerships, Noodle, and iDesign. Trace Urdan, managing director at Tyton Partners, "estimates that the market for OPMs and related services will be worth nearly $8 billion by 2020."

In 2023, the US Department of Education announced that OPMs would be subject to greater oversight, to include audits. Higher education institutions would be required to report details about their agreements with OPMs by May 1, 2023.

Edtech expert Phil Hill recently said that the OPM model is now "on life support."

Financial difficulties, mergers and downsizing

Hundreds of colleges are expected to close or merge, according to research from Ernst & Young.[62] The US Department of Education publishes a monthly list of campus and learning site closings. Typically there are 300 to 1000 closings per year. Notable college closings include for-profit Corinthian Colleges (2015), ITT Technical Institute (2016), Brightwood College and Virginia College (2018). Private college closings include Wheelock College (2018) and Green Mountain College (2019).

In December 2017, Moody's credit rating agency downgraded the US higher education outlook from stable to negative, "citing financial strains at both public and private four-year institutions." In June 2018, Moody's released data on declining college enrollments and constraints, noting that tuition pricing would suppress tuition revenue growth.

Other businesses related to higher education have also had financial difficulties. In May 2019, two academic publishers, Cengage and McGraw Hill, merged.

In 2020, higher education lost 650,000 jobs or about 13 percent of the workforce amid the COVID-19 pandemic, despite an infusion of federal funds. The number of US postsecondary institutions receiving Title IV funding has dropped from 7,253 in 2012–2013 to 5,916 in 2020–2021.

Class privilege and the growth of the educated underclass

Social class has a profound influence on higher education. Undergraduates at elite universities have a substantial advantage if their parents also went to a particular college.[73] Educator Gary Roth, a left-wing writer, has argued that with fewer good jobs for graduates, the US has been producing an "educated underclass." While upward social mobility continues to be available for immigrants and first generation people, the route to upward social mobility is more complicated for people from families that have been in the US longer.

Protests, political clashes, and the growth of right-wing politics

The growth of power among right wing groups has been apparent since the mid-2010s. Turning Point USA (TPUS), now the most dominant conservative presence on US campuses, has clubs at more than 2500 college campuses. Charlie Kirk, its founder, also took over Students for Trump in 2019.

The Chronicle of Higher Education has documented groups such as the Groypers who have infiltrated conservative organizations on campus.

Student protests and clashes between left and right appeared on several US campuses in 2017. On August 11, 2017, white nationalists and members of the alt-right rallied at the University of Virginia, protesting the removal of a statue of Robert E. Lee. The following day, one person died during protests in Charlottesville. Following this event, speaking engagements by Richard Spencer were canceled at Texas A&M University and the University of Florida.

Everybody wants a lower tax bill. One way to accomplish that might be to live in a state with no income tax. At present, seven states—Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming—levy no state income tax at all.1 In addition, Washington levies an income tax on investment income and capital gains, but it is only for certain high earners. Elsewhere, New Hampshire currently taxes investment and interest income but is set to phase out those taxes starting in 2023. That will bring the number of states with no income tax to nine by 2027.2

KEY TAKEAWAYS

States With No Income Tax

Before you pull up stakes and hire a moving company to take everything you own to one of these enlightened lands, you might want to consider other factors, including:

In addition, legislation is always changing. For example, though Tennessee used to tax investment and interest income, the Hall income tax was fully repealed as of Jan. 1, 2021.3

The table below illustrates the differences among states with no income tax. The first two columns show the state’s total tax burden (state income taxes + sales and excise taxes + property taxes) as a percentage of personal income followed by the rank that the state holds (best to worst) among all 50 states.4

The third column shows the state’s affordability ranking, which combines both the cost of housing and cost of living, and the last column includes the state’s rank on the U.S. News & World Report “Best States to Live In” list.56

| Comparison of States With No Income Tax | ||||

|---|---|---|---|---|

| No-Tax State | Total Tax Burden (% of income) | Total Tax Burden Rank (1=lowest) | Affordability (1=best) | Best State to Live in (1=best) |

| Alaska | 5.06% | 1 | 40 | 49 |

| New Hampshire | 6.14% | 3 | 36 | 6 |

| Tennessee | 6.22% | 4 | 14 | 24 |

| Florida | 6.33% | 5 | 38 | 10 |

| Wyoming | 6.42% | 6 | 18 | 26 |

| South Dakota | 6.69% | 7 | 8 | 12 |

| Nevada | 7.69% | 19 | 34 | 38 |

| Texas | 8.01% | 22 | 33 | 35 |

| Washington | 8.24% | 26 | 46 | 2 |

Sources: WalletHub Tax Burden by State, U.S. News & World Report Affordability, and U.S. News & World Report “Best States to Live In” rankings

1. Alaska

Total Tax Burden: 5.06%

Alaska has no state income or sales tax. The total state and local tax burden on Alaskans, including income, property, sales, and excise taxes, is just 5.06% of personal income, the lowest of all 50 states.4

All residents of Alaska receive an annual payment from the Alaska Permanent Fund Corp. made up of revenue and investment earnings from mineral lease rentals and royalties.7 The per citizen dividend payment for 2023 was $1,312.8

Alaska has one of the highest and fastest-rising healthcare costs of any state in the U.S.9 That said, at $13,642 per capita in 2020—the most recent year the Centers for Medicare and Medicaid Services (CMS) Office of the Actuary reported statistics as of September 2023—it also spent the most on healthcare, excluding the District of Columbia.10 Alaska also spent $19,540 per student in fiscal year 2021, the highest of any other state.11

2. Florida

Total Tax Burden: 6.33%

This popular snowbird state features warm temperatures and a large population of retirees.1213 Sales and excise taxes in Florida are above the national average, but the total tax burden is just 6.33%—the fifth-lowest in the country.4

As of 2023, Florida ranks 38th in affordability due to its higher-than-average housing costs. It's affordability has also been steadily decreasing, as it was ranked as the 31st most affordable state in 2020.5 Still, Florida came in at 10 on the U.S. News & World Report “Best States to Live In” list.6

In 2021, Florida was one of the lowest states regarding education spending per capita at $10,401.11 In 2021 the ASCE gave Florida a C grade for its infrastructure.14 Six years earlier, Florida received the same grade from the Education Law Center for the fairness of its state school funding distribution.15 In 2014, its healthcare spending per capita was $8,076, $31 more than the national average; six years later, Florida spent $9,865 per capita in 2020.10

Florida does impose a 5.5% corporate income tax but exempts all or part of that tax for LLCs, sole proprietorships, and S corporations.

3. Nevada

Total Tax Burden: 7.69%

Nevada relies heavily on revenue from high sales taxes on everything from groceries to clothes, sin taxes on alcohol and gambling, and taxes on casinos and hotels.16 This results in a state-imposed total tax burden of 7.69% of personal income for Nevadans, the second-highest on this list. However, it still ranks a very respectable 19 out of 50 when compared with all states.4

That said, the high costs of living and housing put Nevada closer to the bottom (34) when it comes to affordability.5 The state ranks 38th on the U.S. News & World Report “Best States to Live In” list.6

Nevada’s spending on education in 2021 was $10,450, among the lowest quartile across the United States and the fourth-lowest in the western region of the U.S.11 The latest infrastructure report card (as of 2023) from ASCE in 2018 gave Nevada a grade of C for its infrastructure.17

Nevada has also historically had low spending habits in relation to healthcare. Nevada’s healthcare spending in 2014 was $6,714 per capita, the lowest on this list and the fourth-lowest nationally. This has since increased to $8,348 per capita but is now the third lowest by state.10

4. South Dakota

Total Tax Burden: 6.69%

Like many states with no income tax, South Dakota rakes in revenue through other forms of taxation, including taxes on cigarettes and alcohol.18 The home of the Lakota Sioux and the Black Hills has one of the highest sales tax rates in the country and above-average property tax rates.51920 South Dakota’s position as home to several major companies in the credit card industry, in addition to higher property and sales tax rates, helps to keep the state’s residents free from income tax, according to reporting by The Atlantic.

South Dakotans pay just 6.69% of their personal income in taxes, according to WalletHub, ranking the state eighth in terms of the total tax burden.4 The state ranks 8th in affordability and 12th on the U.S. News & World Report “Best States” lists.56

South Dakota spent $8,933 per capita on healthcare in 2014, the 14th highest in the nation. This has since improved as the latest report from 2020 shows South Dakota spending $12,495 per capita, good for 8th in the nation.10 Although it spent more money on education, at $10,952 per pupil in 2019, it spent less than any other neighboring Midwestern state.11

South Dakota hasn’t received an official letter grade from the ASCE, though much of its infrastructure is notably deteriorated, with 17% of bridges rated structurally deficient and 90 dams considered to have high hazard potential as reported in 2021.21

5. Texas

Total Tax Burden: 8.01%

The Lone Star State loathes personal income taxes so much that it decided to forbid them in the state’s constitution.22 Still, because infrastructure and services must be paid for somehow, Texas relies on income from sales and excise taxes to foot the bill.423

Sales tax can be as high as 8.25% in some jurisdictions.24 Property taxes are also higher than in most states, the net result of which is a total tax burden of 8.19% of personal income. Nevertheless, Texans’ overall tax bite is still one of the relatively lowest in the U.S., with the state ranking 22nd.4 Texas is average for affordability at 33rd in the nation, but it was ranked 35st by U.S. News & World Report on the “Best States to Live In” list.56

Texas spent $11.005 per pupil on education in 2021.11 Also in 2021, the ASCE awarded it a grade of C for its infrastructure.25 Texas spent $6,998 per capita on healthcare in 2014, the seventh-lowest amount in the U.S. This since increased to $8,406 per capita, good for the fourth-lowest in the nation.10

One advantage of living in a no-tax state is that the $10,000 cap on state and local tax (SALT) deductions imposed by the Tax Cuts and Jobs Act will likely not have as great an impact as it does on residents of high-tax states, such as California and New York.26

6. Washington

Total Tax Burden: 8.24%

Washington hosts a young population, with only 15.9% of its residents over age 65, and many major employers, thanks to the lack of state-mandated corporate income tax (note that high-income earners are subject to state capital gains tax).2728 Residents do pay high sales and excise taxes, and gasoline is more expensive in Washington than in most other states. The state comes in at 26 out of 50, with a total tax burden of 8.24%.294

Unusually higher-than-average living and housing costs hurt Washingtonians, putting the state at 46th in terms of affordability.5 For some residents that might not matter, however, because their state was ranked by U.S. News & World Report as the overall second best state to live in.6

Washington spent $7,913 per capita on healthcare in 2014, $132 below the national average. By 2020, Washington was spending $9,265 per capital, good for 40th.10 Conversely, at $15,570 per pupil, it spent more on education than most in 2021, though it received a C grade for its school funding distribution six years earlier.1115 In 2019, Washington earned the same grade for its infrastructure from the ASCE.30

7. Wyoming

Total Tax Burden: 6.42%

With an estimated six people per square mile, Wyoming is the second least densely populated state, bested only by Alaska, which has roughly one human being for every square mile.31 Citizens pay no personal or corporate state income taxes, no retirement income taxes, and enjoy low sales tax rates.32 The total tax burden—including property, income, sales, and excise taxes as a percentage of personal income—is 6.42%, ranking the state sixth lowest.4

Like Alaska, Wyoming taxes natural resources, primarily oil, to make up for the lack of a personal income tax, according to reporting in the Cowboy State Daily. The state ranks an average 18th in affordability and 26th on the U.S. News & World Report list of “Best States to Live In.”65

In 2021, Wyoming spent $18,144 per pupil; among the best quartile of U.S. states and more than double that per student of it's neighbor Idaho.11 It also earned a grade of A for its school funding distribution back in 2015, the best on this list.15

Wyoming’s healthcare spending in 2020 was also relatively strong at $10,989 per capita.10 Although Wyoming hasn’t received an official letter grade for its infrastructure yet, the ASCE found that 6.9% of its bridges are structurally deficient and 99 of its dams have a high hazard potential in 2021.33

8. Tennessee

Total Tax Burden: 6.22%

Before 2016, Tennessee taxed income from investments, including most interest and dividends but not wages.3 Legislation passed in 2016 included a plan to lower taxes on unearned income by 1% per year until the tax was eliminated at the start of 2021.34

With full implementation of the new legislation, Tennessee expects to attract retirees who depend heavily on investment income. The state’s total tax burden is 6.22%, the fourth-lowest in the nation.4 In the affordability category, Tennessee ranks 14th overall, and on the U.S. News & World Report “Best States to Live In” list, it ranks 24th.56

In 2021, at $10,507 per pupil, Tennessee ranked towards the bottom across the United States in terms of education spending.11 At $9,336 per capita, Tennessee also ranked towards the bottom in terms of healthcare spending in 2020.10 The state hasn’t received an official letter grade for its infrastructure yet, although the ASCE did note that 4.4% of its bridges are structurally deficient and 276 of its dams have a high hazard potential.35

9. New Hampshire

Total Tax Burden: 6.14%

New Hampshire does not tax earned income but does tax dividends and interest. New Hampshire’s Senate passed legislation to phase out the investment income tax by 1% per year over five years, with full implementation by 2027.2 The state has no state sales tax but does levy excise taxes, including taxes on alcohol, and its average property tax rate of 1.86% of property values is the third highest in the country.3637

Even so, New Hampshire’s total tax burden is just 6.14%, according to WalletHub, ranking the state third in the nation.4 The state ranks sixth on the U.S. News & World Report list of “Best States to Live In” and 36th in the nation for affordability.65

New Hampshire almost spent more on education than any other state on this list at $19,443 per pupil in 2021, though it is outspent by several of its northeast neighbors.11 New Hampshire also received a marginally better grade of C- for its infrastructure in 2017.38 At $11,793 per capita in 2020, its healthcare spending is the twelfth highest in the nation.10

Which Are the Tax-Free States?

As of 2023, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.

Why Do States Charge a State Tax?

Following the adoption of the U.S. Constitution, the federal government was granted the authority to impose taxes on its citizens. Each state also retained the right to impose what kind of tax it wanted, excluding any that are forbidden by the U.S. Constitution as well as its own state constitution. These states fund their governments through tax collection, fees, and licenses.39

Which States Don’t Tax Retirement Distributions?

Twelve states do not tax retirement distributions. Illinois, Mississippi, and Pennsylvania don’t tax distributions from 401(k) plans, individual retirement accounts (IRAs), and pensions. The remaining nine states that don’t levy a state tax at all are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Alabama and Hawaii also don’t tax pensions but they do tax distributions from 401(k) plans and IRAs.40

Which States Tax Social Security Benefits?

There are only 12 U.S. states that tax Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont, and West Virginia.41

The Bottom Line

Despite the challenges no-tax states face, some seem to find a balance among low taxes, affordability, and providing a great place to live. Others struggle. One thing is clear: Low taxes alone do not provide a complete picture of the cost of living for any state.

Part One:

General Aspects of Purchase and Sale of Real Property

INTRODUCTION: REAL ESTATE TRANSACTIONS: IS A LAWYER REALLY NEEDED?

Ownership of land and improved property ("real property" or "real estate") within the United States has long been a goal and accomplishment of both citizens and noncitizens who arrive in this country. Both in terms of investment and in terms of acquiring a home, real estate transactions often form the single largest purchase of the average person and can be an excellent method to build up wealth. Recent tax laws have made the ownership of a home even more beneficial, not only allowing full deduction of interest on the home loan, but delaying or avoiding entirely capital gains upon the sale of a residence. When these tax benefits are combined with the steadily appreciating real estate market in California over the past five years, ownership of property has been seen to be the most intelligent major investment of the average American.

In the United States any legal entity (individual, partnership, corporation, or limited liability company, whether citizen of the United States or not) can own any real property and the laws of the state in which the property is located normally control the legalities of how to purchase, lease, sell, and use real property. Most understandings regarding real property are required to be in writing or are unenforceable, thus the written documents concerning property are of the highest import.

Increasingly over the past hundred years, the government has imposed additional obligations and controls over use of property, both in terms of allowed use ("zoning restrictions") and in imposing liabilities for various types of misuse (violations of building codes; violations of environmental laws such as improper disposal of waste materials on the property; etc.) Further, especially in the sale of homes, the government has imposed remarkably complex requirements of disclosure of problems and potential problems that the buyer may encounter, from defects in construction, to disclosure to the buyer of the property's location in flood or earthquake zones. The government has become a not so silent partner to every real estate transaction and the parties that ignore that fact take great risks.

It is an oddity that many people who would seek legal counsel for drafting a small will or suing someone who dents a fender on their car do not seek legal counsel when buying an asset which they may own for decades, which may cost a million dollars and which imposes thirty years of obligations on the buyer. Most people execute purchase documents or leases without bothering to carefully read the tens of pages of detailed legalese and only obtain legal advice when something goes wrong...and by then it is often too late. It is an obvious but often ignored fact that someone, sometime took the time and money to draft the complex form document that the real estate broker asks the buyer or seller to execute; clearly whoever drafted that complex document presented to the buyer or seller was drafting that long form for a reason, not at random. For a party to execute such a form without a full and complete understanding of its terms is equivalent to signing a blank check.

As with much of law, the best time to obtain legal advice is before a dispute or problem arises and it is a simple fact that a major portion of the contractual litigation in the United States involves real estate and alleged breach of leases or purchase agreements.

While real estate brokers and agents usually have form agreements, and while most landlords avail themselves of the preprinted form leases created decades ago by unknown persons, the fact of the matter is that these forms are usually antiquated, often inappropriate, and invariably a shock to the persons bound when they finally read them, usually long after signing them and after a heated argument with the other party. Properly drafted documents involving real estate are a necessity and more than any area of the law, written documents are usually required to form a binding obligation regarding real estate.

Another often ignored fact is that almost all professionals involved in real estate transactions have their own interests which do not necessarily conform to those of the buyer, seller, lessor or lessee. Real estate brokers and agents are usually only paid if a transaction culminates and are paid more if the transaction is higher in price. Clearly, such parties do not have an objective stance to take when examining the benefits and detriments of a particular transaction. Likewise, the lenders, the title companies, the builders, and the mortgage brokers are all interested parties who seek to have a transaction culminate simply because that is how they are paid.

If one seeks truly objective analysis of the cost benefit and detriments of a real estate transaction, and if one wishes an objective review of the contractual documents, one is compelled to seek expert legal advice from an attorney whose task is not to encourage the culmination of the transaction regardless of the consequences. It is the fact that attorneys so often advise of the negative aspects of transactions that have given them the reputation for being "deal killers." However, to consider both the good and the bad of the transaction is precisely why lawyers should be retained in real estate matters. One client put it well: often, the most money that can be made from a transaction is made by walking away from the transaction. Usually, the only professional who will so advise is the lawyer reviewing it.

TYPES OF REAL ESTATE TRANSACTIONS:

While the variations on the type of real estate transactions are as broad as the ingenuity of human kind, most transactions involve the purchase, sale, lease, construction, or subdivision of a piece of reality. The topics of commercial leases, rental of residences, construction and of subdivision of real property are each complex enough to justify a lengthy article in themselves and are the topics of other articles on this website. This article will, instead, concentrate on the general topic of purchase and sale of realproperty.

The Basic Purchase/Sale Transaction of Realty in California

The average purchase and sale of realty in California is comprised of the following parties and entities:

1. The Buyer;

2. The Seller,

3. Real estate broker or agent representing either the Buyer or Seller or, at times, both; sometimes two or more brokers are involved in the transaction.

4. A lending institution which finances the transaction;

5. A title company which examines the "chain of title" of the property to ensure that the Seller has title to sell to the Buyer and, in effect, acts as an insurance company insuring the validity of the title to Buyer;

6. The County Recorder who records the title documents showing ownership has vested in the Buyer (usually with a Grant Deed to the Buyer and Deed of Trust or Mortgage in favor of the Lender);

7. Often a mortgage broker who arranges financing between the Lender and Buyer;

8. Various experts who examine the condition of the property and create a report before close of the transactions (such as termite and dry rot inspectors; engineers, soil engineers, architects, etc.);

9. The escrow agent who holds the money and the title documents of all the parties and distributes them pursuant to written instructions;

10. If a condominium or home owners association is involved, that organization must be joined by the buyer.

STEPS IN THE TYPICAL TRANSACTION

While transactions may vary widely, the usual stages are:

1. A real estate broker shows a listed property to a prospective buyer. The buyer decides he/she wishes to make a bid and does so, usually rendering a few thousand dollar deposit along with the bid and signing a form that the broker usually supplies labeled, "Offer."

2. The broker presents the offer to the seller or the seller's broker and they can accept it (signing on the form), reject it, or counter offer with an offer of their own. The counter may involve a different price or different financing or requirements such as requiring buyer to pay for correction of defects discovered by the inspectors, etc. or perhaps accepting the Property "as is."

3. Each offer or counteroffer gives the other party the right to accept. If they accept before one withdraws an offer or counteroffer, both parties are bound. All offers and counteroffers must be in writing to be legally effective.

4. Once there is an acceptance, then within a time period listed in the documents the buyer normally is required to obtain financing, usually from a bank or savings and loan, while various inspectors such as termite and dry rot inspectors, soil engineers, etc, visit the property and render a written report as to its condition. The offer normally requires that the property "pass" all such inspections or the buyer may withdraw the offer and receive the deposit back. Quite often if the property fails to pass a particular inspection, the buyer and seller will negotiate as to who pays for the repairs...often they split them.

5. If financing is not possible, the deal falls through. If financing within the guidelines of the offer is achieved, then the buyer is bound and must proceed with the deal.

6. All deposits, inspection reports, title documents, down payment, bank documents and sums go to an escrow officer who holds the monies and documents pursuant to written instructions and only releases the various documents and sums to the parties when the conditions are met. The parties normally split the costs of the escrow officer. Buyer must also purchase enough insurance on the property to protect the lender if the property is destroyed or damaged and proof of insurance is also deposited into escrow.

7. One of the documents deposited into escrow is title insurance. This is a document prepared by a title insurance company that warrants that the title is in the name of the seller and that seller is empowered to transfer title to the buyer.

8. The brokers are normally paid from the sums deposited into escrow and the typical transaction has the Seller paid in full by a combination of the bank (who takes back a "deed of trust" or "mortgage") and the down payment of the buyer. Down payments are normally between twenty and thirty percent.

Thus, a typical transaction for a three hundred thousand dollar structure will have the following computations:

Down payment will be about sixty thousand dollars. The bank must lend $240,000. Closing costs (costs of escrow, title insurance and the like) will be about six or seven thousand dollars and the broker will be paid by the Seller between $15,000 to $20,000 for their fees. Buyers normally pay for the title insurance, half of escrow costs, and the inspections. Realistically, a buyer in the above scenario should plan on spending cash of close to seventy thousand dollars to close the deal while the Seller will only receive about $280,000 once the broker and the escrow people are paid.

THE ROLE OF THE REAL ESTATE BROKER

In the United States the overwhelming majority of transactions involve real estatebrokers who are licensed professionals who receive, usually, a percentage of the sales price of the property being sold (the "commission.") A broker has a fiduciary duty (duty of loyalty) to the person represented and can only represent both the buyer and seller if they both consent. Usually two brokers are involved and they split the commission which is normally between five and six percent of the selling price of most property. The commission is paid from escrow upon the close of the transaction. The commission is NOT set by law and may be negotiated with the broker.

Brokers take on the bulk of the work of the real estate transaction, seeking property to show to a prospective buyer or showing the listed property of sellers. Brokers often have access to computerized listings of all property for sale thus can quickly ascertain what property may be appropriate for a buyer.

Brokers normally have written contracts with their clients and those contracts, like their commissions, can be negotiated but often are not since most laypersons are intimidated by the lengthy form contracts presented to them by the broker. Most such contracts give the broker an "exclusive" right to list the property for a stated period of time, such as ninety days, during which only the broker can sell the property.

As experts, brokers can often give valuable advice as to the negotiations occurring, the proper price to bid, and the dangers involved in the location of the property, etc. Brokers normally have complex long legal documents which they suggest their clients execute to both bid, accept bids, counteroffer and culminate the sales transaction. These forms, written by the brokers' associations, are quite complete and fully binding on the parties. Just reading such documents can take well over an hour and most buyers or sellers, in a hurry to place or accept a bid or counteroffer, do not bother to carefully read the terms.

Indeed, most brokers simply use the forms without careful analysis of their contents, having received the forms from their associations and usually using them for years without a second thought.

A broker earns nothing if a sale does not occur. This necessarily creates a bias in the minds of most brokers in that they seek to encourage culmination of any sales transaction. Further, the higher the price, the more they earn. While this may seem fine for the seller and bad for the buyer, it actually also distorts their advice even to a seller since they will often recommend costly improvements to the property to help it sell which, of course, increases the sales price thus the commission.

Most brokers are honest and hardworking. It is a competitive and stress filled job requiring long hours on weekends and nights. Nevertheless, while their role is extremely valuable, a wise seller or buyer understands that their economic position within the transaction makes objective advice hard to obtain from a broker.

THE LENDER

Either by use of a mortgage broker who seeks possible loans from banks, or via the broker who usually has connections with various banks, or on their own, the average buyer does not buy real estate for cash but purchases it by borrowing most of the sales price from a bank or savings and loan association. The usual transaction requires a twenty to thirty percent down payment, with fifteen to thirty year financing for the remainder of the purchase price. Thus a three hundred thousand dollar home will normally require a down payment of anywhere from sixty to ninety thousand dollars plus a loan for the remainder, at interest rates that vary but will normally be around seven to ten percent over thirty years. Bank loans come in an enormous variety of terms including variable interest rates, graduated payment schedules, federally insured, etc, etc.

Several thousand dollars are also spent to arrange the loan ("points") and to arrange for title insurance on the title, perform the termite and dry rot inspection to determine the condition of the property, and to obtain the insurance that any lending institution will require before loaning on the property. It is typical to spend perhaps five thousand dollars to "pay" for the loan before the first payment is due.

Most loans in California are secured with a document called a Deed of Trust on the property being financed. Without going into detail, the Deed of Trust allows the lender to foreclose and seize the property by an out of court procedure should payment not be made in a timely manner. Normally, the procedure for foreclosure is to record a Notice ofDefault in the recorder's office which gives the borrower ninety days to cure the default by paying all sums due and the costs of the foreclosure recordation. At the end of ninety days, if no payment has been made, the Notice of Sale is recorded and the right to cure the default in payment expires. The lender can then sell the property to pay down on the loan.

In California, there is no deficiency judgement; that is, assuming the property is a home which the buyer can no longer afford, if the lender forecloses on the property the lender can not also sue the borrower for the difference between the proceeds of the foreclosure sale and the amount due under the loan. Nevertheless, the borrower who suffers such a foreclosure normally has his or her credit history ruined for many years.

CONCLUSION:

The tax benefits of ownership of realty and the usual appreciation of property in California are added incentives for the ownership of property but it must be recalled that real property in California, over the past hundred years, has averaged perhaps 8% appreciation a year and if appreciation for a period exceeds that, it must be expected that there will be years of depreciation to counterbalance the previous rise. In the last twenty years real property has decreased in price for periods of three to five years three or four times and it is critical for the buyer to recall that a vibrant and expanding economy must ultimately end, at least for a period. One must not automatically purchase property relying on future appreciation to justify the debt incurred since location, the surrounding economy, and just plain luck can often have drastic effects on value of property.

Nevertheless, careful and planned purchase of real property has been the typical method of appreciation of wealth for new citizens and Americans alike and an expanding population seems to assure that while cycles may cause temporary downturns in the market, that overall the demand for realty will continue to expand.

(Quelle:https://www.stimmel-law.com/)

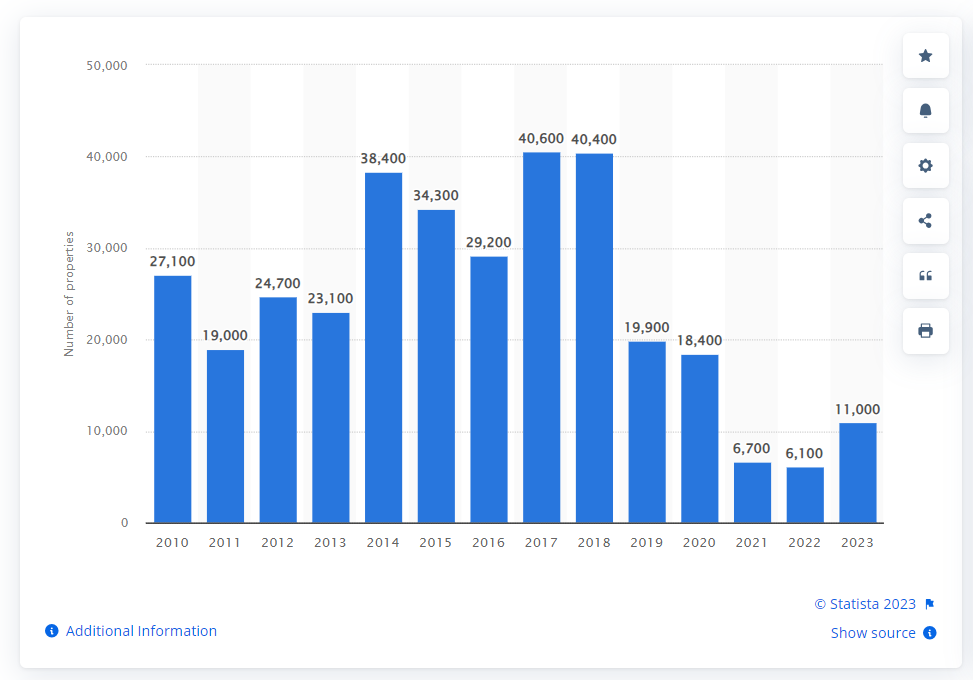

Chinese buyers comprise one of the largest groups of foreign buyers of residential property in the United States. In 2017, a record number of residential properties were bought by Chinese nationals, but since then, both the sales volume and percentage of all foreign-bought properties has declined. In 2023, Chinese buyers were responsible for 13 percent of all sales to foreigners.

Who is the biggest buyer of U.S. residential property?

During the coronavirus pandemic, buyers from Canadian and Mexican origin dominated international transactions, but in 2022 Chinese nationals bought the most U.S. residential property. They were also responsible for the largest share of the aggregate value of properties purchased. On average, Chinese bought properties were also substantially more expensive than the ones purchased by other buyer groups, such as Canadians.

How has the market developed?

The total property sales to foreign buyers peaked at 153 U.S. dollars in 2017, followed by a period of declining transaction value. The coronavirus pandemic has significantly contributed to cross-border transactions remaining subdued. In 2022, the value of property sales to foreigners was the lowest observed since recording began.

Published by Statista Research Department, Sep 27, 2023

一、美国的免税州

全美共有五个州面消费税,分别是Oregon(俄勒冈州),Alaska(阿拉斯加州),Delaware(特拉华州),Montana(蒙大拿州)和New Hampshire(新罕布什尔州)。另外,New Jersey(新泽西)部分免税。

如果游客们想要买大件物品,又正好要到这几个州旅游,可以考虑在这些州购物,可谓是感恩节首选。

但需要注意的是,虽然这5个州的州政府不对任何商品征税,州内的地方政府(市政府)却会征收购物消费税。比如阿拉斯加的地方税超高可达7%,新罕布什尔的地方税超高3%。

另外,以下几点需要特别提醒:

1、美国大多数州对农产品(如蔬菜,水果,蛋类,牛奶,谷物)免税。

2、处方药只有伊利诺伊州征税。

3、对于非处方药(营养保健品,如维他命)除5个免税的州外,还有纽约,俄勒冈,得克萨斯,弗吉尼亚(Virginia),宾夕法尼亚(Pennsylvania)等州免税。

4、对于服装类商品,明尼苏达,新泽西,宾夕法尼亚等州是免税的;马萨诸塞州(Massachusetts)对$175以下、纽约对$110以下、佛蒙特州(Vermon)对$100以下的服装免税。

二、美国各州消费税率一览表

在非免税州中,加州的州消费税税率超高,达到7.5%(+上local为8.48%)。另外5州的州消费税税率达到7%,分别是Indiana(印第安纳)、Mississippi(密西西比)、New Jersey(新泽西)、Rhode Island(罗德岛)和Tennessee(田纳西)。

除了州税,地方政府还征收称为Local Sales Tax的地方消费税。以德克萨斯州为例,德州的州消费税率为6.25%。

但是地方可以收取超高达2%的地方税,综合起来,在德州买东西大多数时候要交总计8.25%的消费税。

三、美国的免税日

为了促进消费,美国有些州每年会在特定的日期实行免税政策。在免税日,购买规定类别的商品是完全免税的,常见的免税品有:学校用具,衣服,鞋子,节能产品等。

以下是2016年各州的免税日和相关的免税物品,供大家参考。

四、游客可以退税的州

游客在外国购物通常能享受退税,但在美国只有极少州可以退还游客消费税,以加州为首的旅游业超发达的州,都没有退还游客消费税的相关规定。

销售税是美国各州政府自行征收,全美目前只有Texas丶Louisiana(路易斯安那)有退税点,外国游客可以凭外国护照,以及往返美国90天内的机票凭据,退销售税。土豪州Texas甚至还允许美国公民退税,当然前提是购买人能提供将购买物品带出国使用的证明。

五、网购如何避免消费税

美国现行的法律没有对跨州网络交易征收消费税。简单的说,就是卖家和买家如果在同一个州,卖家就要向买家收销售税,如果不在一个州,就不需要收。大一些的卖家,会明确的告知哪个州(或者哪些州)的买家需要支付销售税,这些州,就是卖家公司的所在地、销售地或者仓储所在地。

如果网上购物的收货地点为免税州,不管在哪个网站购物,都是可以免税的。

也有一些网站对多数州的买家免税,却只对个别州征税。比如时尚百货Bergdorf Goodman对大部分州免税,但对于New Jersey,New York, Pennsylvania, Texas的网购订单则不免税。

再比如截止2016年2月,网络购物巨头亚马逊只对全美28个州征收消费税。

大家在网上购物的话可以“税比三家”,买的东西多了,省下的购物税也是一笔不小的开支呢。

现在到美国置业买房的人越来越多,我们今天就来谈谈在美国购买了房地产,是否拥有土地的所有权,如果有的话,是否有年限或其他限制。

美国的国土面积982万平方公里,除掉66万平方公里的水面,土地面积为916万平方公里,其中大约三分之一强归政府所有,其余为私人财产。

在美国购买的房地产,通常说的都是土地和地上建筑等不动产,业主对它们拥有永久产权,可以作为遗产由后代继承,也可以捐赠或出售。在许多地方,业主每年要向地方政府交纳房地产税,用做当地中小学教育和其他方面的经费。房地产的价值会随着市场波动,业主如果将房屋出租的话,在报税时可以用建筑物的折旧冲抵收入,但是历史趋势来看,美国房地产会持续升值。

土地作为房地产的一部分,业主拥有它的产权,地表和地下的自然资源除非有法律规定,通常也都是业主的财产。

单门独户房产的情况比较简单,业主直接拥有房屋与土地的产权。自从1960年代以来,联邦、州以及地方政府出于环境保护等方面的考虑,对于私人土地上的野生动植物和其他环保事项可能制定有相关的法律法规,业主需要了解并遵守。

以西雅图市为例,如果业主的地块位于环境保护的敏感地区,例如陡坡、野生动物栖息地和湿地等,在未经许可的情况下,不得砍伐任何林木或者破坏地表植被。在其它尚未开发的土地上,未经专业人员鉴定具有危险,不得砍伐直径6英寸(7.5厘米)以上的树木。如果地块已经开发,除非经过鉴定有危险,不得砍伐任何具有历史、生态或美学价值的树木,其他直径6英寸以上的树木一年内砍伐不得超过3棵。尚未利用的土地业主打算开发,则在申报批准建房的地段管制相对宽松,但是也必须符合该市的绿色评估标准,尽可能对环境加以保护和美化。

一般来说,如果房产位于统一规划开发的社区,而且居民组织有小区业主管理委员会,则大家共同拥有对涉及公共领域事务的管理权,表现为具有法律效力的小区建筑规范与章程。例如有的居民小区对房屋的外观式样和颜色有严格的规定,不得随意增添附加建筑,甚至连邮箱的颜色规格和门牌号码等都需要符合标准。

至于公寓房屋,一般的公寓业主与单门独户一样拥有自己单元的房屋产权,至于公共区域例如大楼前厅、走廊和电梯楼梯间、非付款购置的公共停车位以及健身房休闲设施等,包括公寓楼的地皮,则属于所有住户共有。美国还有很多地方有合作公寓,它们表现为所有业主组成的非营利公司,每个业主购买的是相应于自己单元的该公司股份,所以其土地权利也是表现为股份形式,其它方面与公寓没有实质的区别。

美国私有土地的地下资源,通常也是属于业主所有,但是其权利可能与地上建筑分开,所以在那些矿藏丰富的地区购买地产时,要特别注意是否包括地下资源的权利。在这方面,几乎所有的州都有相应的法律加以规范。

地表与地下资源捆绑在一起的地产,在美国被称为“单纯费率房地产”(fee simple estate)。100多年前在俄克拉何马、得克萨斯以及美国南部海湾地区发现大量石油,企图发财的人们纷纷涌入投资“黑金”,连带使得地产交易复杂化,人们开始将地表和地下资源分别出售。我们的下一篇博文将介绍这方面的情况。

(Quelle:https://share.america.gov/)

与许多国家规定只有本国公民才可以拥有土地不同的是,美国法律对外国人购买、继承、拥有土地的规定与本国公民没有什么不同,一视同仁;外国人可以购买土地、继承土地所有权,也可以购买房产,由于房产与土地是连在一起的,购买房屋时,往往同时拥有了房屋所在土地的永久所有权。

外国人在美国购买房地产虽然没有什么法律限制,但值得一提的是,有些居住小区、高层公寓、合作公寓以及老年社区的管理委员会对房产购买有特别的审核规定,目的是保证本小区居民的素质,因此外国人购买者在投资这些房产时事先应了解清楚相关规定。

美国土地

在美国的房地产市场,外国买家一直很活跃,据全国房地产经纪人协会(National Association of Realtors)的统计,在2016年4月到2017年3月的12个月中,外国买家购买的房地产价值1530亿美元,比上一年同期增加49%,创历史新高。这个数字大出经济学家的预料,因为这一时期美元走强,相对来说美国的房地产就显得比较贵,但外国买家显然并没有被美元走强吓到,还是大举投资美国的房地产,外国买家总共购买了28万栋房产,这个数目比上一年同期增长了32%。

从总体上看,外国买家占现房买卖额的10%以及现房买卖数量的5%,这说明外国买家购买的房地产平均价格是美国人的一倍。在所有外国人购买的房地产中,以卖买额来看的话,一半集中在佛罗里达、加利福尼亚和德克萨斯三个州。此外,新泽西、亚利桑那、纽约、华盛顿特区也是外国买家青睐的州。

来到美国之后,生活中最常做的是就是和各种税打交道,由于美国的特殊历史背景,每个州有很大的自治权,这也就造成了不同的州有各自的税收系统,有些州的税高得吓人,有些州却可能是免税州,虽然很少有人来美国伊始就选择一个税收上占有的州去生根发芽,但是在生活的过程中了解一些各个州的税收政策,对于我们规划之后的职业发展,退休计划,还有开公司做生意可是有大大的帮助的!尤其对于做跨境电商的朋友,选对了州注册公司或许能省下今后的一大笔支出。这篇文章我们就着重从公司的角度,来聊一下所谓的免税州有哪些,又免了哪些税。

美国税务分为联邦税和州税,联邦税是公司必须要缴纳的,联邦税是公司必须要缴纳的,21%,有营业就必须报税,但如果无利润则不需要缴纳。州税要看每个州的法律政策,再说到免税州时很多朋友会把公司和个人层面的免税州搞混,对于公司而言,我们要免得是公司所得税,对于打工者而言,我们希望越少缴纳个人所得税越好,而从消费者的角度而言,没有消费税才是天堂,了解了这其中的区别,我们就能更清楚的取区分不同种类的免税州了。

· 无公司所得税:怀俄明(Wyoming),内华达(Nevada)和南达科他(South Dakota)

· 无个人所得税:怀俄明(Wyoming),内华达(Nevada),南达科他(South Dakota),阿拉斯加(Alaska),佛罗里达(Florida),德克萨斯(Texas)和华盛顿州(Washington)

· 无消费税:阿拉斯加(Alaska),特拉华(Delaware),蒙大拿(Montana),新罕布什尔(New Hampshire),俄勒冈(Oregon)—我们平常口中的五大免税州。

对于提高收入少扣税而言,怀俄明,内华达和南达科他州无疑是最好的选择,企业和个人都可以最大化自己的税后收入,而从节省开支少交钱而言,不用缴纳消费税的五大免税州是最后的购物天堂,不过值得一提的是,阿拉斯加虽然在州的层面上没有消费税,但是有些城市会收取一定的消费税。

内华达州、南达科他州和怀俄明州是美国对公司来说纳税政策最为友好的三个州。这三个州在公司设立方面典型的几个优惠包括:1. 州内不对公司和个人收取所得税;2. 对公司的股份不收取费用;3. 不对公司征收特许经营税(虽然设立时和每年的报表和营业执照的存续会产生费用);4. 公司的股东、董事会成员、管理层不需要是州内居民。

但是,在关注这三个州的优惠政策的同时,也应注意这些优惠政策的局限。这些税收、费用上的优惠建立在公司的实际运营地在州内这一前提之上。如果公司的营业地不在州内,或是除了该州以外还有其他营业地,则很有可能会以“境外公司”的身份触发其他州的缴税义务。例如,如果一家在内华达州注册的公司,如果在纽约州有商业活动、办公地点,并产生了营业收入,则该公司很有可能需要缴纳纽约州的公司、个人所得税。

对于创业公司来说,在事业初期,可以选择在公司的实际运营地进行注册,这样的方式更为方便,也省去了州外的注册代理的维护费用。当公司发展到一定阶段,根据公司融资、上市等战略方面的要求,注册地在特定州更加有利时,可以再去该特定州注册一个公司,然后通过控股关系解决这一问题。

除了上面三个免税州,特拉华不能不提,特拉华是美国上市公司设立的首选地。在美国的证券交易所上市的公司中,超过一半的公司(包括64%的财富500强公司)选择在特拉华设立。特拉华还是外州公司(即总部和设立地位于不同州的公司)设立数量最多的州。特拉华在立法,税务和服务上对于公司有着极大的优惠和保护,为了吸引投资,还采取了许多优惠政策,虽然它不是公开的免税州,但是如果不在当地经营业务,也无需缴纳公司所得税,就是说你可以在特拉华州注册公司,而在别州甚至别国经营业务,从而达到合理合法避税的效果。

目前来说,非美国人在美国注册公司最多的三个州分别是特拉华州、怀俄明州、内华达州。这三个州由于相对较低的运营费用以及低税免税政策被视为“公司友好型”州。(南达科他州除了免公司税以外,在其他配套法律和政策上并没有特别大的优势,所以并不是注册公司的首先)。其中,以亚马逊开店的非美国电商卖家更多的会注册在特拉华州、怀俄明州。

由于面向商业方面的法律制度,通常大公司都会选择在特拉华州进行注册,也就C-Corporation类型的公司倾向于特拉华州,这也是财富500强公司的聚集地。而对于小企业,比如一人公司,在怀俄明州注册则更有优势。怀俄明州申请费较低,并且大多数情况下年报只有50美元,不必支付特许经营税,也没有州所得税。

对于跨境电商卖家来说,特拉华更适合已经有一定规模的大公司,特拉华州没有销售税,并且如果公司不在特拉华开展业务的话,也没有州所得税。这些对于从事电商业务来说非常重要。也就是说,每年只需支付175-300美元(取决于公司类型),加上年度报告费50美元,完成年报即可。而怀俄明州的费用则更低,50美元年报费用,没有特许经营税,也没有州所得税,怀俄明州是小企业的首选。

希望这篇文章能给希望在美国成立公司的朋友一些帮助,关于具体注册公司的事宜,还是要咨询专业的注册会计师或者商业律师。 (Quelle:https://www.nystartax.com/)

Major film studios are production and distribution companies that release a substantial number of films annually and consistently command a significant share of box office revenue in a given market. In the American and international markets, the major film studios, often known simply as the majors or the Big Five studios, are commonly regarded as the five diversified media conglomerates whose various film production and distribution subsidiaries collectively command approximately 80 to 85% of U.S. box office revenue.[1][2][3][4] The term may also be applied more specifically to the primary motion picture business subsidiary of each respective conglomerate.[2]

Since the dawn of filmmaking, the U.S. major film studios have dominated both American cinema and the global film industry.[5][6] U.S. studios have benefited from a strong first-mover advantage in that they were the first to industrialize filmmaking and master the art of mass-producing and distributing high-quality films with broad cross-cultural appeal.[7] Today, the Big Five majors – Universal Pictures, Paramount Pictures, Warner Bros. Pictures, Walt Disney Studios, and Sony Pictures – routinely distribute hundreds of films every year into all significant international markets (that is, where discretionary income is high enough for consumers to afford to watch films). The majors enjoy "significant internal economies of scale" from their "extensive and efficient [distribution] infrastructure",[8] while it is "nearly impossible" for a film to reach a broad international theatrical audience without being first picked up by one of the majors for distribution.[4] Today, all the Big Five major studios are also members of the Motion Picture Association (MPA) and Alliance of Motion Picture and Television Producers (AMPTP).

Die National Football League (NFL) ist eine US-amerikanische Profiliga im American Football. Sie besteht aus 32 Teams, die als Franchises in der National Football Conference (NFC) und der American Football Conference (AFC) organisiert sind. Beide Conferences, die im Wesentlichen aus den 1970 vereinigten Konkurrenzligen NFL und AFL bestehen, sind wiederum in je vier Divisionen unterteilt.

Die Saison beginnt nach einer mehrwöchigen Preseason, in der nur Testspiele bestritten werden. Während der achtzehnwöchigen Regular Season bestreitet jedes Team 17 Spiele, daran anschließend spielen die besten Teams in den Play-offs um den Meistertitel. An diesen nehmen jeweils die vier Divisionssieger und die drei weiteren besten Teams (die sogenannten Wildcard-Teams) einer Conference teil. Die daraus ermittelten Meister von AFC und NFC treffen im Super Bowl aufeinander, der am zweiten Sonntag im Februar stattfindet.

Amtierender Meister sind die Kansas City Chiefs, die sich im Super Bowl LVII gegen die Philadelphia Eagles mit 38:35 durchsetzten.

Mit einem Jahresumsatz von bis zu ca. 15,3 Milliarden US-Dollar (2019) ist die NFL die umsatzstärkste Sportliga der Welt.